FINANCIAL INDEPENDENCE

Having enough wealth which can maintain one’s lifestyle without anxiety caused by income volatility over a lifetime.

FINANCIAL INDEPENDENCE

Having enough wealth which can maintain one’s lifestyle without anxiety caused by income volatility over a lifetime.

Simplifies execution and develops discipline to generate better long-term returns.

Maximizes your free time so that you don’t have to micromanage.

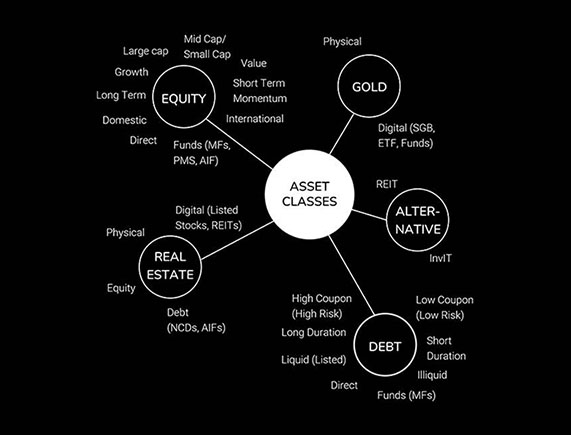

Reduces volatility by diversifying across multiple asset classes.

Reduces psychological impact of colossal wealth erosion during major market corrections.

Reduces untimely exits from the market.

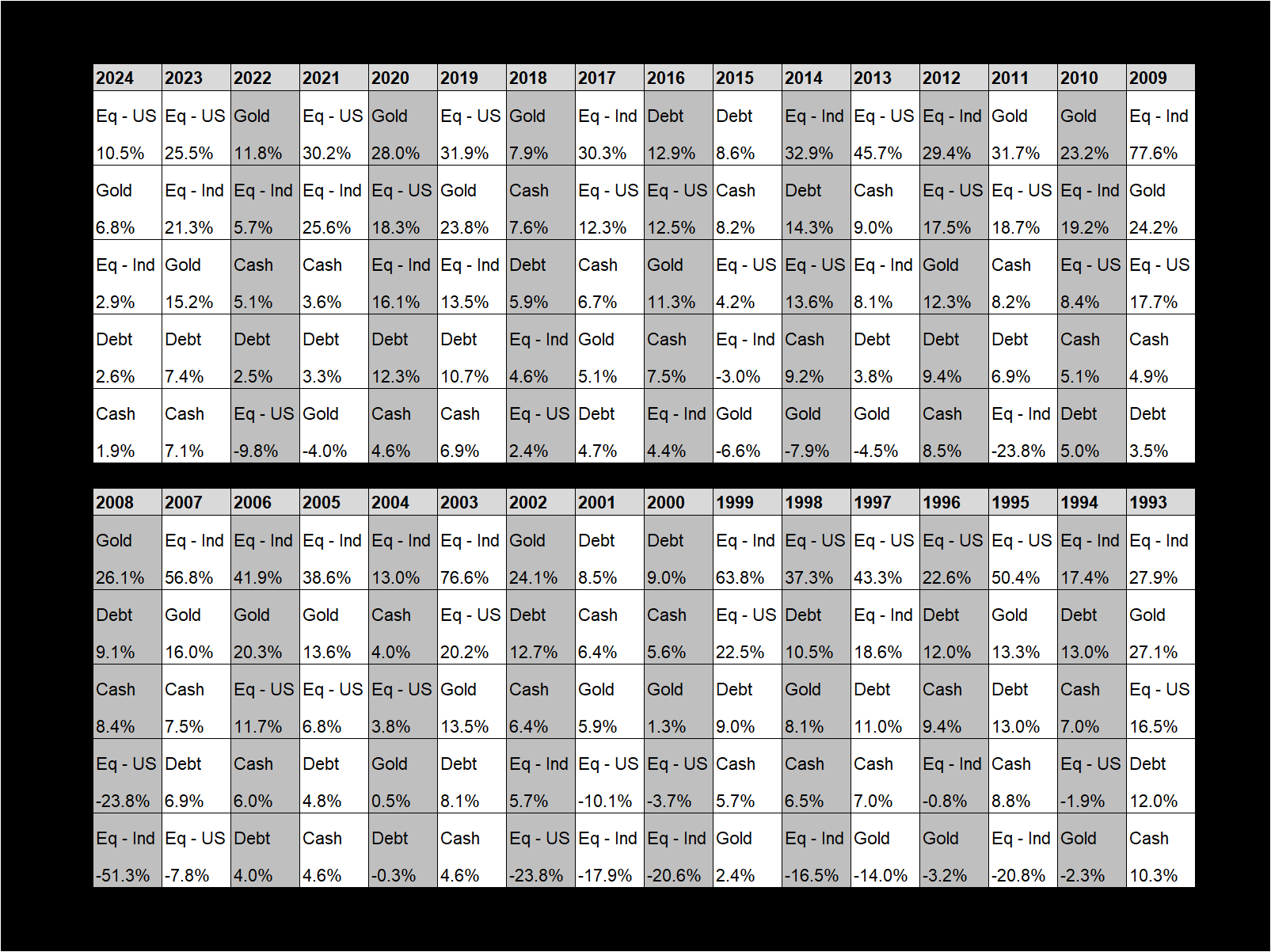

Valuation / Returns potential as the determining criteria.

Outperforms other strategies in the long run by capturing transitions in the markets and shifting weights accordingly.

FINANCIAL INDEPENDENCE

Having enough wealth which can maintain one’s lifestyle without anxiety caused by income volatility over a lifetime.

Email - [clients@dvia.in]

Contact number - 8591426656