There is a huge disparity in returns from an asset class depending on entry and exit points in the respective asset class, even over long periods of time ~30 years.

Owing to a chaotic movement among various asset classes, invariably, the outperformance of an asset class is countered by underperformance of another asset class, leading to subdued performance at a portfolio level over such long periods.

This involves dynamically shifting weights from asset classes in the Red zone into asset classes in the Green zone, thus generating superior risk-adjusted returns sustainably over prolonged periods.

Minimal Involvement - Maximum Returns

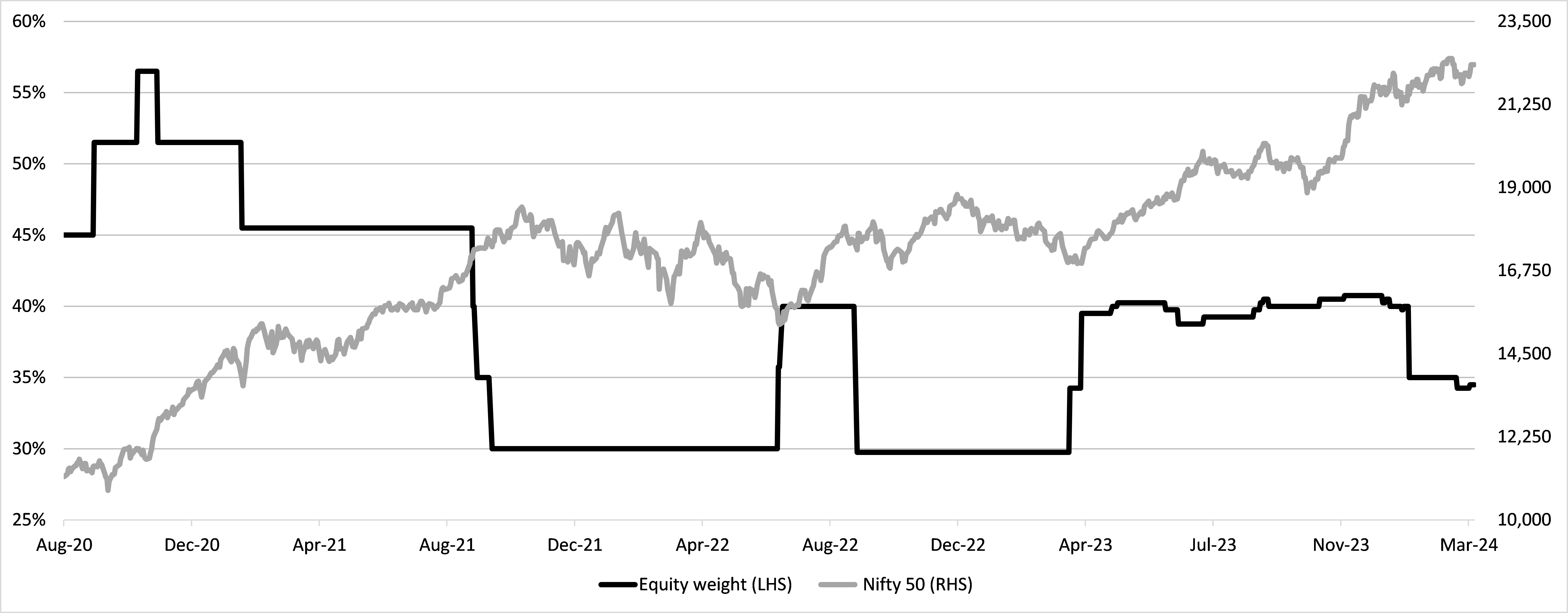

DVIA's model portfolio follows a Dynamic Asset Allocation approach with investments across multiple asset classes like Domestic / International Equities, Debt, REITs, InvITs, Gold, etc.

Each asset class and security within the asset class has assigned weights. These are rebalanced periodically in accordance with the proprietary CAGR-cum-valuation led algorithm.

Each rebalancing leads to capturing excess returns of each asset class, earning debt returns in the interim periods and then reentering at better levels for next round of returns.

When done consistently over long periods, this approach shall outperform static allocation, either partly or wholly, in any one particular asset class.

| Asset Class | Aug 15, 2020 | Highest Allocation | Lowest Allocation | Mar 31, 2024 | Change in last 1 yr |

| Equity - Indian | 45% | 56.5% | 28.75% | 29.5% | -7.5% |

| Equity - International | 0% | 5% | 0% | 5% | +5% |

| Total Equities | 45% | 56.5% | 28.75% | 34.50% | -2.5% |

| InvIT | 5% | 5% | 0% | 0% | 0% |

| REIT | 1% | 15% | 1% | 10% | 0% |

| Gold | 0% | 5% | 0% | 5% | 0% |

| Debt | 49% | 57% | 37.5% | 50.5% | +2.5% |